We recognize the readers of the Estancia News are already busy with commitments related to their families, employment, educational, and community commitments. As such, we will endeavor every week to keep this section of the publication as short, simple, and helpful as possible.

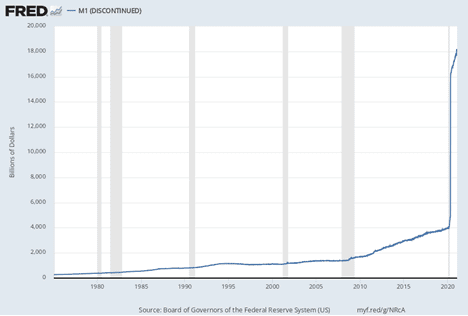

Arguably, the most important financial or economic issue facing families in Estancia is monetary inflation. Despite what our trusted mainstream media and Washington elites want us to believe, monetary inflation is the direct result of an increase in the number of Dollars circulating in the U.S. The increase in the number of Dollars is caused by “printing” more Dollars and/or fewer people wanting to use them. It is simple supply and demand that affect the value (price) of a Dollar.

Historically, the U.S. Dollar was printed on “paper” currency. Today, however, inflation occurs as more U.S. Dollars are “printed” digitally. The more Dollars are printed, the less valuable every existing Dollar becomes. If world demand for the Dollar grows at the same time, the Federal Reserve can print more Dollars without the average person noticing any change in the Dollar’s purchasing power. If demand for Dollars grows at the same pace the supply of Dollars grows, the “price”, or value, of the Dollar remains constant.

The supply of Dollars has been DRAMATICALLY increasing over the past year, while the demand for Dollars has begun to plummet. The primary reason behind the decrease in the demand for the Dollar has to do with oil sales. Countries that once purchased or sold oil in Dollars are now doing so in other currencies. Why? It’s a long story we will save for another article.

Since Dollars are needed substantially less to purchase oil, more Dollars held by other nations will find their way back to the U.S. More Dollars are returning to the U.S. than are being sent abroad because other nations are using Dollars less and less to conduct business. Combining the net return of Dollars to the U.S. with the increase in Dollars already in the U.S. because of the Federal Reserve’s digital money printer, you now have a LOT more Dollars available to Americans for buying and selling than a year or so ago.

More Dollars are circulating in the U.S. Fewer goods are available for consumers in the U.S. to buy (we will save that for another article). When more Dollars meets fewer goods, prices go up. The “official” inflation rate is reported to be about 8.5%, but we know the actual inflation rate is at least double (once again, another article).

If you have seen increases in the prices of food and fuel, those increases are the result of more dollars, less food and fuel, or both. The bad news is inflation is going to get much, MUCH worse. The good news? We will save that for another article, too. We promised to keep this short, so cut us some slack.

- Breaking: Dominion/Liberty Vote Tabulator flips a vote in Chaves County – Changing the Outcome of a School Board Election - December 12, 2025

- Liberation for New Mexico is Coming - August 18, 2025

- ATTENTION DOGE: Department of Energy’s Land Grab in New Mexico and Colorado for “Green Energy” Must be Stopped - February 17, 2025