New Mexico finds itself with one of the largest sovereign wealth funds and a recent record tax surplus, yet we’re continually asked to approve more bond issues—at both the state and county levels. Bonds are debt, obligating taxpayers to long-term repayment with interest. This approach adds to the state’s financial burdens and shifts the cost to taxpayers, especially through escalating property taxes. Not only do bonds raise property taxes, but they also increase when the assessor re-evaluates property values each year, resulting in a double hit for taxpayers. Instead of piling on more debt during a time of record inflation, it’s time for New Mexico to manage its finances responsibly and show accountability for existing funds.

The Growing Burden on Property Owners

Across New Mexico, counties are proposing bond issues for various projects. From Bernalillo to Santa Fe and beyond, local governments are asking voters to approve bonds that will add to the property tax burden. While these bonds are often pitched as necessary for improvements to public infrastructure, they create long-term debt that property owners ultimately pay for through higher taxes.

New Mexico imposes a 3% cap on property value increases to stabilize tax bills, but this cap doesn’t prevent long-term increases. Property re-evaluations and statutory rises continually push property taxes higher, placing a growing strain on homeowners and small businesses. The Albuquerque region alone has seen significant bond proposals on the ballot, with the costs likely to be passed along to residents in the form of higher taxes for years to come. The effects of rising property taxes are particularly visible in Sandoval County, where many small businesses, residents of Corrales, and even retirement communities have experienced significant hikes. In the past six months alone, property tax increases have hit small businesses hard, with some seeing spikes as high as 600%. A retirement community’s property taxes for their community center were raised similarly, putting essential community resources at risk. Property owners in Corrales report that their assessments do not reflect the actual market value of their property but a flat rate across the village, yet they face higher valuations regardless.

Residents and small business owners have voiced their concerns to the Sandoval County Commission, only to be told that nothing can be done to alleviate the burden. Despite these pleas, the Commission has recently shown support for bond issues that would further increase property taxes. It’s a disheartening reminder that the burden of government debt and spending is often shifted onto the very people who can least afford it.

Corporate Welfare and Taxpayer Cost

Counties across New Mexico also issue bonds for economic development through IRBs and LEDA funding, offering tax breaks to corporations. While these measures are intended to attract businesses, they often shelter companies from property taxes, placing the financial burden on residents. It’s time for local governments to reassess these incentives, focusing instead on reducing the tax burden for citizens and ensuring that corporate welfare doesn’t come at the expense of the taxpayer.

Education and Healthcare: A Call for Accountability

New Mexico ranks last in education, and while bond issues promise improvements, there’s little evidence of progress. Bond funds are allocated to schools, but without clear accountability measures, taxpayers have no assurance that this money is making a difference. For example, performance metrics like graduation and literacy rates should be tied to future funding, yet this is rarely enforced.

The healthcare sector presents similar issues. Bond funds often go to facility improvements, yet New Mexico still ranks poorly in health outcomes. Chronic illnesses, mental health issues, and access to care remain problems, particularly in rural areas. Counties proposing healthcare bonds need to tie these funds to specific improvements in healthcare delivery and access, ensuring that taxpayer money directly benefits communities in measurable ways.

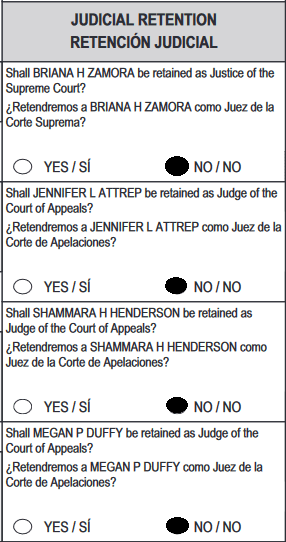

Judicial Retention and Public Safety

Judicial retention decisions at the county and state levels are often automatic, but in a state with one of the highest crime rates, we must demand accountability. The Judicial Performance Evaluation Commission’s recommendations should reflect direct improvements in public safety, yet retention decisions are routinely made without sufficient scrutiny. Taxpayer dollars fund the judicial system, and residents deserve assurance that their investments lead to safer communities. Several New Mexico judges have signed a loyalty agreement to a radical leftist organization called “Emerge.” New Mexicans don’t need judges who will legislate from the bench for a political agenda. Check here to see if your judges are Emerge judges.

Fiscal Responsibility and Accountability

New Mexico doesn’t need more bond issues or unchecked judicial retentions. Counties should demonstrate financial responsibility by using existing resources effectively and transparently. Instead of approving more debt, New Mexicans should demand that current funds be managed wisely, with clear performance standards and measurable results.

By voting no on these state and county bond issues, and judicial retentions, New Mexicans can send a strong message that we expect our government to prioritize accountability and fiscal responsibility. With the sovereign wealth fund and recent surpluses, we have the means to make substantial improvements without raising taxes. It’s time to build a state and local government that works for everyone, not just those who benefit from unchecked spending.

- Opinion | SB 218—New Mexico’s Promise Made, Promise Broken - February 24, 2025

- New Mexico’s Supreme Court Ignores Rights and Restricts Who Can Hear Election Cases - January 9, 2025

- Progressive Blueprint: How EMERGE’s Legislative Surge is Poised to Reshape New Mexico - January 6, 2025